Market Report: May 22, 2024

Insights by Leston Alvarez, Trader

Following a significant upturn on Monday, the U.S. grain and oilseed sectors saw a slight decline early today. U.S. corn futures dropped by 2 to 3 cents per bushel this morning, following an 8-cent increase in the July contract yesterday.

U.S. wheat futures are currently down by 2 to 5 cents, pausing after a notable surge of 27 to 37 cents in yesterday’s July contracts.

The rise in wheat prices on Monday was largely due to forecasts of drier and warmer conditions in Russia, which could negatively affect wheat during its critical reproductive stage. This has led analysts to reduce their projections for Russian wheat production to between 82 and 84 million metric tons. The escalating conflict between Ukraine and Russia, including a recent Ukrainian drone strike on Russia’s grain export facility in Novorossiysk—though the damage was reportedly minimal—continues to add uncertainty to the region’s agricultural outputs.

U.S. soybean values are also down, falling 4 to 10 cents this morning after a notable jump of 20 cents on Monday, closing at $12.48 per bushel.

Meanwhile, ICE canola futures are slightly up by less than $1 per tonne after remaining idle on Monday due to the Victoria Day holiday, seemingly unaffected by yesterday’s gains in the U.S. agricultural markets.

In the U.S., corn and soybean planting is seeing varied progress. Recent widespread rainfall across the Midwest and Plains—coupled with more expected this week—has impacted planting schedules. According to the USDA, U.S. corn planting is 70% complete, slightly ahead of market predictions yet just below the five-year average.

About 52% of U.S. soybeans have been planted, outpacing market expectations and compared to 61% last year and a 49% average. Emergence is at 26%, which is ahead of the typical 21%.

The condition of U.S. winter wheat has slightly declined, with 49% rated as good to excellent, down 1% from last week. This is contrary to analysts’ expectations of an improvement. The crop’s development, however, is progressing well, with 69% headed compared to a five-year average of 57%.

As for U.S. spring wheat, 79% has been planted, significantly ahead of the five-year average, with 43% emerging, also above average.

Canadian Grain market

ICE canola futures did not trade on Monday due to the Victoria Day holiday, yet they experienced a noticeable uptick last Friday, buoyed by an increase in Chicago soy oil prices.

Last week’s planting setbacks across the Prairies further bolstered prices.

On Friday, July canola climbed $9.60 to close at $661.10 per tonne, while the November contract gained $7.70, ending at $680.90.

As of today, Canola’s futures are showing little change, with a mix of slight increases and decreases in the early contracts. This tepid reaction comes despite the significant gains in the CBOT soy complex yesterday while the canola market remained closed. However, lower prices this morning in soybeans, soy oil, Malaysian palm oil, and EU rapeseed futures are tempering the momentum for canola.

In terms of chart movements, July canola futures briefly touched $669 overnight before dipping slightly to $660.80, a modest decrease of $0.30. Recently, July futures have fluctuated within a short-term range of $650 to $670, awaiting a catalyst for a more definitive move.

According to last Friday’s CFTC report, speculative funds in canola have reduced their net-short positions, lowering them from 71,513 contracts to 56,780 as of May.

Trade Highlights

Explore a snapshot of the latest market moves by clicking the "View All Trades" button.

Looking to buy or sell grain?

Connect with our Team in your Area

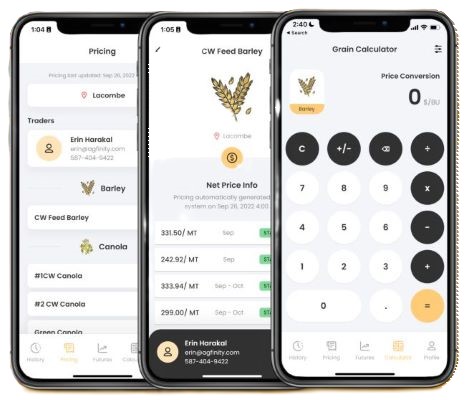

Grain Marketing App

Maximize Your Grain Marketing Strategy with Agfinity’s Mobile App!

Explore trade history, leverage our powerful Agfinity Grain Calculator, stay updated with local pricing, and tap into a live futures feed—all conveniently from your mobile device.