The coronavirus has impacted businesses and lives around the world. Here at Agfinity our once vibrant trading pit is now just a desolate office with a skeleton staff as our traders have shifted to working remotely from our home offices. For me, a resident of Camrose, careers have always come with hours upon hours of daily commuting, navigating icy roads and way too may missed family dinners. Is working remotely the new norm? Although covid has come with many negatives I feel some businesses may have stumbled upon an unexpected positive. The reduced time commuting allows the opportunity for employees to start earlier and work later without having to miss that ever-important family and personal time. Working at home also provides opportunities to eat healthier and frees up time to schedule in some exercise. A happy, healthy employee is a more productive employee.

The coronavirus has impacted businesses and lives around the world. Here at Agfinity our once vibrant trading pit is now just a desolate office with a skeleton staff as our traders have shifted to working remotely from our home offices. For me, a resident of Camrose, careers have always come with hours upon hours of daily commuting, navigating icy roads and way too may missed family dinners. Is working remotely the new norm? Although covid has come with many negatives I feel some businesses may have stumbled upon an unexpected positive. The reduced time commuting allows the opportunity for employees to start earlier and work later without having to miss that ever-important family and personal time. Working at home also provides opportunities to eat healthier and frees up time to schedule in some exercise. A happy, healthy employee is a more productive employee.

On the business side the impacts have been noticeable but what kind of impact have we seen directly from Agricultural Producers? By its nature, farming is unpredictable so there should be know better group to handle this uncertainty than farmers. From a local standpoint it’s been a very difficult time for restaurant suppliers and our local farmers markets. Covid has shifted how and where some people purchase their food. For many that have been dedicated local buyers, covid restrictions and health concerns have put them on hold from browsing at our local markets. One of the sectors hit hardest by covid was restaurants. When restaurants get hit, in a chain reaction so do our local suppliers. The large agricultural producer have also had their fair share adversity to navigate through. The food-supply chain was impacted in the early days of covid with bottlenecks at ports and unpredictable demand patterns. These cause volatile prices and creates difficult decisions for the producer.

Covid is still impacting our daily lifestyle and consuming patterns. This is going to impact members of the Agricultural Community in different ways for many years to come. But the one thing we know for sure is we’ll always need reliable agriculture production, and that Farming is Forever.

Because Farming is Forever

Craig Wark

Market Report – by Joseph Billett

Election 2021 – Liberals to preside over a minority in Government after the government spent $612 billion I did appreciate the fancy pencil I received when I voted. Justin Trudeau won a third straight election on Monday, and fell short of the majority Trudeau sought in a vote called two years earlier than the law required. The Liberals will return to government with what will effectively be a cabinet shuffle of Parliament. Even today several riding still too close to call with many mail-in ballots still to be counted. The divisive 36-day campaign was the shortest period allowed by law.

We realize for farmers this is not popular thinking however it seems to be apparent that the top of the market may have come and gone, specifically feed prices have topped out in our opinion. Corn, corn, and corn is coming in western Canada and has a bearish sent going into 2022. We are seeing a bigger spread in bids daily as sellers search for the price from 2 weeks ago. There is still demand and strong pricing to be had for October and possibly first half November. Lethbridge cash feed barley bids reached as high as $425/tonne may be as high as it needs to go given the wave of cheaper corn from the US that we see potentially coming our way this autumn/winter. Cash Lethbridge barley bids have clawed back to the $390-$395/tonne range. Corn is coming in strong around $350-360/MT dlvd into southern Alberta starting in November. When talking to feeders once they switch to corn they will keep that as their rations for 5-6 months. This will dramatically soften feed grain demand.

Canola futures are in-decline. We’re hearing that spot canola bids may be leveraged by basis levels, not the futures. Canola price is expensive relative to the competing worlds oilseed markets, but this is necessary to be discourage demand from what will be a tight Canadian canola stock this year.

Yellow Pea bids have pulled back about 10% from recent highs. Last week StatsCan lowered its 2021 pea yield to 24.9 bu/acre, analysts figure that the adjusted crop estimate is now 2.4 mln tonnes. The StatsCan estimate of July 31 stocks was 479,000 tonnes. On a positive note the most recent crop report from Sask Ag showed 87% of the 2021 pea crop a grading a #2CW or better. The USDA estimated its 2021 pea crop down 44% from last year, which will increase their import requirements. Imports to China on peas dropped to only 28,000 tonnes in August and September will be low as well. The rally in US yellow peas has softened off, which has lowered bids in Canada as of late.

Call us on cash flax bids anything above $30/bu is worth picking up the phone for and posting an offer up. A month ago, brown and yellow flax was $23.36-25.33/bu and this week we are seeing Brown flax around $30.84/bu and yellow flax up $4.00/bu to $36.67/bu.

Durum bids are also pulling back . . . 1CWAD with 13% pro bids are still strong but bids are being seen around $18/bu FOB farm across the south of western Canada.

Buyer Brief – by Sandra Correia-Letendre

A couple weeks ago we were still seeing rally’s for a few commodities: barley, wheat, peas, corn. In the last week, we have seen these commodities take a tumble. Within a matter of a few days Barley dropped approximately $25/mt. I must say this was a game changer when it happened, buyers were getting back to actively bidding and sellers back to selling. However, this has slowed down in the last few days.

Barley is now trading closer to $385/mt delivered Lethbridge for Sept/Oct movement. The last few days we have seen barley prices stabilize at this level. Most bids we have been receiving are still for Sept/Oct, not a lot coming in yet for further out. This of course can be a result of many buyers wanting to see what’s going to happen when corn hits the market in a little over a month.

Corn is now trading at approximately $355/mt delivered Lethbridge for Nov/Dec. There has been a lot of talk about Corn amongst some feedlots, not knowing if they want to change rations from Barley with the market going down now. This makes it tough to buy out further than their immediate needs. Many buyers feel the price of Barley may still go down with the pressure of the Corn prices.

Wheat has been holding its own while other feed grains fall in price. Currently, we are seeing Feed Wheat trade at $390/mt delivered Lethbridge for Sept/Oct. Milling to feed grades are not that far off in price. For #1 HRS 13 pro, we are seeing bids around $10.60-10.70/bu FOB Central Alberta.

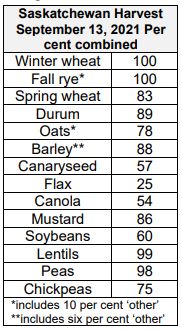

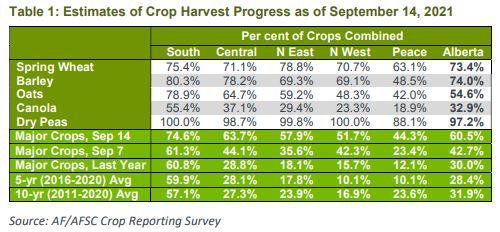

From some articles I’ve read it sounds like harvest is approximately 90% complete for Spring Wheat, Barley and Oats. Some market analysts are really pushing the idea that sellers should sell now before Corn comes in. Once feeders start buying Corn, they will be buying until next year as they will not want to change their rations. Let’s see what next week brings.

Seller Tips: Still quick movement opportunities to get some cash flow.

Recent Trades

NC OS CW Feed HRS Wheat (ID: 20521)

88.00 MT

FOB Little Smoky, AB

Sep 23 – Oct 31

$389.31/MT or $10.60/BU (Gross)

$385.81/MT or $10.50/BU (Net)

TRADED Sep 22, 2021

NC #2CW HRS Wheat (ID: 20468)

44.00 MT

FOB Benalto, AB

Sep 21 – Sep 30

$393.50/MT or $10.71/BU (Gross)

$390.00/MT or $10.61/BU (Net)

TRADED Sep 21, 2021

Feed Oats (ID: 20369)

1320.00 MT

FOB Provost, AB

Sep 20 – Nov 30

$328.50/MT or $5.07/BU (Gross)

$325.00/MT or $5.01/BU (Net)

TRADED Sep 21, 2021

NC CW Feed Barley (ID: 20519)

44.00 MT

FOB Crestomere, AB

Sep 21 – Oct 15

$374.00/MT or $8.14/BU (Gross)

$370.50/MT or $8.07/BU (Net)

TRADED Sep 21, 2021

NC CW Feed Barley (ID: 20518)

88.00 MT

FOB Marshall, SK

Sep 20 – Oct 01

$354.86/MT or $7.73/BU (Gross)

$351.36/MT or $7.65/BU (Net)

TRADED Sep 20, 2021

OS Feed Yellow Peas (ID: 20398)

30.00 MT

FOB Radway, AB

Dec 01 – Dec 31

$407.68/MT or $11.10/BU (Gross)

$404.18/MT or $11.00/BU (Net)

TRADED Sep 20, 2021

NC OS Feed Oats (ID: 20505)

44.00 MT

FOB High Prairie, AB

Sep 21 – Sep 30

$260.00/MT or $4.01/BU (Gross)

$256.50/MT or $3.96/BU (Net)

TRADED Sep 20, 2021

NC #2 Yellow Peas (ID: 20510)

44.00 MT

FOB Fort Vermilion, AB

Jan 01 – Jan 31

$528.76/MT or $14.39/BU (Gross)

$525.26/MT or $14.30/BU (Net)

TRADED Sep 20, 2021

NC OS CW Feed Barley (ID: 20511)

44.00 MT

FOB Wetaskiwin, AB

Sep 16 – Oct 31

$370.00/MT or $8.06/BU (Gross)

$366.50/MT or $7.98/BU (Net)

TRADED Sep 17, 2021

NC Feed Faba Beans (ID: 20509)

44.00 MT

FOB Strathmore, AB

Sep 16 – Oct 15

$460.96/MT or $12.55/BU (Gross)

$457.46/MT or $12.45/BU (Net)

TRADED Sep 17, 2021

CW Feed Barley (ID: 20515)

44.00 MT

FOB Brosseau, AB

Sep 17 – Sep 22

$368.50/MT or $8.02/BU (Gross)

$365.00/MT or $7.95/BU (Net)

TRADED Sep 17, 2021

NC #2 Yellow Peas (ID: 20504)

396.00 MT

FOB Brownfield, AB

Sep 15 – Nov 30

$591.40/MT or $16.10/BU (Gross)

$587.90/MT or $16.00/BU (Net)

TRADED Sep 16, 2021

NC Feed Faba Beans (ID: 20507)

44.00 MT

FOB Strathmore, AB

Sep 15 – Oct 31

$457.29/MT or $12.45/BU (Gross)

$453.79/MT or $12.35/BU (Net)

TRADED Sep 16, 2021

NC #2 Yellow Peas (ID: 20508)

660.00 MT

FOB Estevan, SK

Jan 01 – May 31

$594.90/MT or $16.19/BU (Gross)

$591.40/MT or $16.10/BU (Net)

TRADED Sep 16, 2021

NC #2 Yellow Peas (ID: 20456)

88.00 MT

FOB Medstead, SK

Sep 17 – Oct 15

$554.83/MT or $15.10/BU (Gross)

$551.33/MT or $15.00/BU (Net)

TRADED Sep 16, 2021

NC CW Feed Barley (ID: 20400)

220.00 MT

FOB Major, SK

Oct 01 – Nov 30

$366.35/MT or $7.98/BU (Gross)

$362.85/MT or $7.90/BU (Net)

TRADED Sep 15, 2021

NC OS CW Feed Barley (ID: 20483)

88.00 MT

FOB Leoville, SK

Sep 15 – Oct 31

$352.57/MT or $7.68/BU (Gross)

$349.07/MT or $7.60/BU (Net)

TRADED Sep 15, 2021

NC #2 Yellow Peas (ID: 20408)

44.00 MT

FOB Edmonton, AB

Jan 01 – Mar 31

$576.88/MT or $15.70/BU (Gross)

$573.38/MT or $15.60/BU (Net)

TRADED Sep 15, 2021

Heated Durum (ID: 20497)

308.00 MT

FOB Richlea, SK

Sep 15 – Oct 15

$312.52/MT or $8.51/BU (Gross)

$309.02/MT or $8.41/BU (Net)

TRADED Sep 15, 2021

NC #2 Yellow Peas (ID: 20496)

88.00 MT

FOB Blackie, AB

Sep 14 – Jan 15

$600.59/MT or $16.35/BU (Gross)

$597.09/MT or $16.25/BU (Net)

TRADED Sep 15, 2021

NC Feed Faba Beans (ID: 20501)

44.00 MT

FOB Strathmore, AB

Sep 15 – Oct 30

$457.11/MT or $12.44/BU (Gross)

$453.61/MT or $12.35/BU (Net)

TRADED Sep 15, 2021

NC CW Feed Barley (ID: 20502)

44.00 MT

FOB Stony Plain, AB

Sep 15 – Sep 30

$358.54/MT or $7.81/BU (Gross)

$355.04/MT or $7.73/BU (Net)

TRADED Sep 15, 2021

#2CW Oats (ID: 20473)

132.00 MT

FOB Valhalla Centre, AB

Sep 14 – Sep 30

$344.18/MT or $5.31/BU (Gross)

$340.68/MT or $5.25/BU (Net)

TRADED Sep 15, 2021

NC CW Feed Barley (ID: 20487)

176.00 MT

FOB High Prairie, AB

Sep 16 – Sep 30

$343.38/MT or $7.48/BU (Gross)

$339.88/MT or $7.40/BU (Net)

TRADED Sep 15, 2021

NC CW Feed Barley (ID: 20499)

88.00 MT

FOB Crestomere, AB

Sep 15 – Sep 22

$369.85/MT or $8.05/BU (Gross)

$366.35/MT or $7.98/BU (Net)

TRADED Sep 15, 2021

NC CW Feed Barley (ID: 20482)

44.00 MT

FOB Boyle, AB

Sep 16 – Oct 15

$353.77/MT or $7.70/BU (Gross)

$350.27/MT or $7.63/BU (Net)

TRADED Sep 15, 2021

NC CW Feed Barley (ID: 20488)

88.00 MT

FOB Markerville, AB

Sep 14 – Sep 25

$367.60/MT or $8.00/BU (Gross)

$364.10/MT or $7.93/BU (Net)

TRADED Sep 14, 2021

NC CW Feed CPSR Wheat (ID: 20461)

220.00 MT

FOB Sunset House, AB

Nov 01 – Dec 31

$416.70/MT or $11.34/BU (Gross)

$413.20/MT or $11.25/BU (Net)

TRADED Sep 14, 2021

CW Feed Barley (ID: 20394)

44.00 MT

FOB Barrhead, AB

Sep 14 – Sep 25

$366.00/MT or $7.97/BU (Gross)

$362.50/MT or $7.89/BU (Net)

TRADED Sep 14, 2021

NC CW Feed Barley (ID: 20492)

660.00 MT

FOB Neilburg, SK

Sep 14 – Oct 31

$361.75/MT or $7.88/BU (Gross)

$358.25/MT or $7.80/BU (Net)

TRADED Sep 14, 2021

NC CW Feed CPSR Wheat (ID: 20490)

220.00 MT

FOB Marwayne, AB

Oct 01 – Nov 30

$378.29/MT or $10.30/BU (Gross)

$374.79/MT or $10.20/BU (Net)

TRADED Sep 14, 2021

NC OS CW Feed CPSR Wheat (ID: 20460)

132.00 MT

FOB Glendon, AB

Sep 14 – Oct 31

$370.94/MT or $10.10/BU (Gross)

$367.44/MT or $10.00/BU (Net)

TRADED Sep 14, 2021

NC CW Feed Barley (ID: 20481)

44.00 MT

FOB Stony Plain, AB

Sep 15 – Sep 22

$351.00/MT or $7.64/BU (Gross)

$347.50/MT or $7.57/BU (Net)

TRADED Sep 14, 2021

NC #2 Green Peas (ID: 20484)

44.00 MT

FOB Leoville, SK

Sep 15 – Oct 31

$554.66/MT or $15.10/BU (Gross)

$551.16/MT or $15.00/BU (Net)

TRADED Sep 14, 2021

NC OS CW Feed Barley (ID: 20471)

44.00 MT

FOB Wetaskiwin, AB

Sep 14 – Sep 20

$360.00/MT or $7.84/BU (Gross)

$356.50/MT or $7.76/BU (Net)

TRADED Sep 14, 2021

NC #1CW HRS Wheat (ID: 20480)

440.00 MT

FOB Waskatenau, AB

Sep 13 – Sep 25

$400.00/MT or $10.89/BU (Gross)

$396.50/MT or $10.79/BU (Net)

TRADED Sep 13, 2021

NC CW Feed Barley (ID: 20485)

88.00 MT

FOB Madden, AB

Sep 13 – Oct 15

$368.50/MT or $8.02/BU (Gross)

$365.00/MT or $7.95/BU (Net)

TRADED Sep 13, 2021

NC OS CW Feed Barley (ID: 20478)

220.00 MT

FOB Waskatenau, AB

Sep 13 – Sep 24

$353.50/MT or $7.70/BU (Gross)

$350.00/MT or $7.62/BU (Net)

TRADED Sep 13, 2021

NC #2 Green Peas (ID: 20435)

440.00 MT

FOB St. Paul, AB

Nov 01 – Nov 30

$576.88/MT or $15.70/BU (Gross)

$573.38/MT or $15.60/BU (Net)

TRADED Sep 13, 2021

NC #2 Yellow Peas (ID: 20476)

88.00 MT

FOB Blackie, AB

Sep 14 – Oct 15

$573.03/MT or $15.60/BU (Gross)

$569.53/MT or $15.50/BU (Net)

TRADED Sep 13, 2021

NC #3CW HRS Wheat (ID: 20463)

88.00 MT

FOB Evansburg, AB

Sep 10 – Sep 30

$378.00/MT or $10.29/BU (Gross)

$374.50/MT or $10.19/BU (Net)

TRADED Sep 10, 2021

NC CW Feed Barley (ID: 20437)

440.00 MT

FOB Tofield, AB

Dec 01 – Jan 07

$368.64/MT or $8.03/BU (Gross)

$365.14/MT or $7.95/BU (Net)

TRADED Sep 10, 2021

NC CW Feed Barley (ID: 20465)

220.00 MT

FOB Olds, AB

Dec 01 – Jan 31

$382.42/MT or $8.33/BU (Gross)

$378.92/MT or $8.25/BU (Net)

TRADED Sep 10, 2021

NC OS CW Feed HRS Wheat (ID: 20466)

220.00 MT

FOB Vegreville, AB

Oct 01 – Oct 31

$374.78/MT or $10.20/BU (Gross)

$371.28/MT or $10.10/BU (Net)

TRADED Sep 10, 2021

NC CW Feed Barley (ID: 20469)

220.00 MT

FOB Outlook, SK

Sep 10 – Oct 15

$345.68/MT or $7.53/BU (Gross)

$342.18/MT or $7.45/BU (Net)

TRADED Sep 10, 2021

NC #1CW HRS Wheat (ID: 20452)

528.00 MT

FOB Tofield, AB

Sep 11 – Oct 15

$398.50/MT or $10.85/BU (Gross)

$395.00/MT or $10.75/BU (Net)

TRADED Sep 10, 2021

NC CW Feed Barley (ID: 20470)

44.00 MT

FOB Boyle, AB

Oct 01 – Oct 15

$348.00/MT or $7.58/BU (Gross)

$344.50/MT or $7.50/BU (Net)

TRADED Sep 10, 2021

NC CW Feed Barley (ID: 20464)

44.00 MT

FOB Carbon, AB

Sep 10 – Sep 30

$372.14/MT or $8.10/BU (Gross)

$368.64/MT or $8.03/BU (Net)

TRADED Sep 10, 2021

NC CW Feed Barley (ID: 20462)

88.00 MT

FOB Camrose, AB

Sep 09 – Sep 30

$359.46/MT or $7.83/BU (Gross)

$355.96/MT or $7.75/BU (Net)

TRADED Sep 09, 2021

NC OS Feed Oats (ID: 20438)

88.00 MT

FOB Thorhild, AB

Sep 10 – Sep 18

$282.32/MT or $4.35/BU (Gross)

$278.82/MT or $4.30/BU (Net)

TRADED Sep 09, 2021

NC CW Feed HRS Wheat (ID: 20454)

352.00 MT

FOB Wilkie, SK

Sep 01 – Jan 31

$376.63/MT or $10.25/BU (Gross)

$373.13/MT or $10.15/BU (Net)

TRADED Sep 09, 2021

CW Feed Barley (ID: 20442)

44.00 MT

FOB Vermilion, AB

Sep 10 – Sep 17

$357.16/MT or $7.78/BU (Gross)

$353.66/MT or $7.70/BU (Net)

TRADED Sep 09, 2021

NC CW Feed Barley (ID: 20451)

88.00 MT

FOB Cremona, AB

Sep 09 – Sep 17

$364.05/MT or $7.93/BU (Gross)

$360.55/MT or $7.85/BU (Net)

TRADED Sep 09, 2021

Feed Oats (ID: 20439)

44.00 MT

FOB Bonnyville, AB

Sep 10 – Sep 17

$279.10/MT or $4.30/BU (Gross)

$275.60/MT or $4.25/BU (Net)

TRADED Sep 09, 2021

NC CW Feed Barley (ID: 20458)

220.00 MT

FOB Huxley, AB

Sep 09 – Sep 30

$363.50/MT or $7.91/BU (Gross)

$360.00/MT or $7.84/BU (Net)

TRADED Sep 09, 2021

NC CW Feed HRW Wheat (ID: 20440)

44.00 MT

FOB Hythe, AB

Sep 10 – Sep 30

$389.31/MT or $10.60/BU (Gross)

$385.81/MT or $10.50/BU (Net)

TRADED Sep 09, 2021

NC OS CW Feed Barley (ID: 20407)

132.00 MT

FOB Provost, AB

Sep 10 – Oct 08

$370.94/MT or $8.08/BU (Gross)

$367.44/MT or $8.00/BU (Net)

TRADED Sep 09, 2021

NC CW Feed CPSR Wheat (ID: 20444)

44.00 MT

FOB Newbrook, AB

Sep 08 – Sep 18

$400.16/MT or $10.89/BU (Gross)

$396.66/MT or $10.80/BU (Net)

TRADED Sep 08, 2021

NC CW Feed Barley (ID: 20441)

176.00 MT

FOB Marshall, SK

Sep 08 – Oct 15

$344.93/MT or $7.51/BU (Gross)

$341.43/MT or $7.43/BU (Net)

TRADED Sep 08, 2021

NC CW Feed CPSR Wheat (ID: 20429)

264.00 MT

FOB Spruce View, AB

Sep 08 – Oct 31

$397.25/MT or $10.81/BU (Gross)

$393.75/MT or $10.72/BU (Net)

TRADED Sep 08, 2021

NC #2CW CPSR Wheat (ID: 20434)

176.00 MT

FOB Kinsella, AB

Nov 01 – Dec 31

$392.99/MT or $10.70/BU (Gross)

$389.49/MT or $10.60/BU (Net)

TRADED Sep 08, 2021

NC #2 Yellow Peas (ID: 20431)

258.00 MT

FOB Kinsella, AB

Nov 01 – Mar 31

$584.23/MT or $15.90/BU (Gross)

$580.73/MT or $15.80/BU (Net)

TRADED Sep 08, 2021

NC CW Feed Barley (ID: 20424)

132.00 MT

FOB St. Paul, AB

Sep 08 – Sep 14

$370.94/MT or $8.08/BU (Gross)

$367.44/MT or $8.00/BU (Net)

TRADED Sep 08, 2021